After a strong year, we believe 2022 is shaping up to be another good year for commodities. The theme across most sectors in the asset class is consistent – a fundamental mismatch between supply and demand is driving prices higher. Prices are being further pressured by increasing costs of capital for some (e.g., energy producers), higher input costs for others (e.g., fertilizer for agricultural products), and/or after a decade of underinvestment, a lack of new projects ready to boost supply (e.g., base metals mines). Any weakness in a historically strong USD will further the dollar-denominated sector’s move higher.

Looking across the asset class, one finds inventories of many commodities well below their 5-year averages entering 2022.

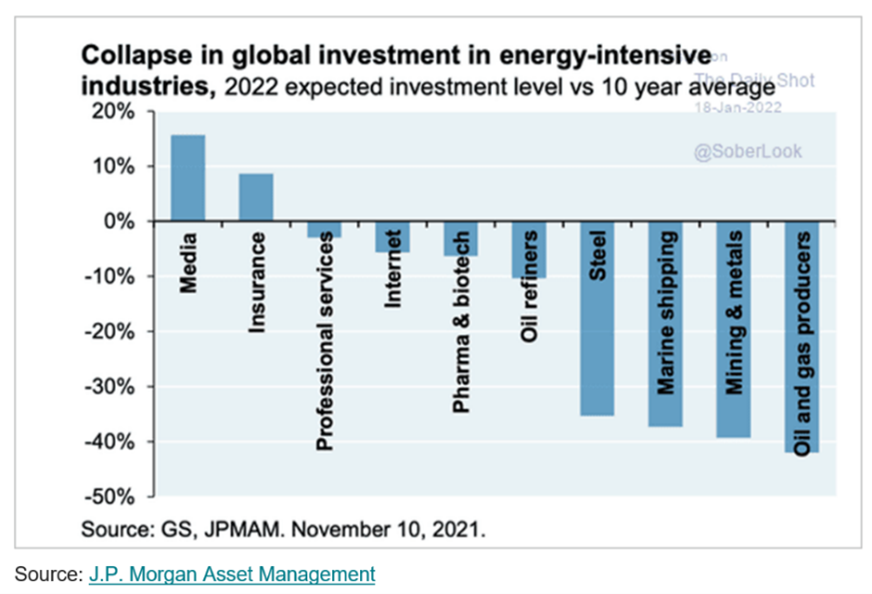

Concurrently, JP Morgan projects global investment in commodity sectors to be the lowest across all sectors this year. This comes at a time where the forces of ESG have driven costs of capital higher, leading major producers of commodities to hold off on investing until higher prices are sustained for a longer period.

Fundamentally, physical assets are driven by volumetric levels rather than expectations, which fuel financial assets. When supply cannot meet demand, and inventories cannot bridge that gap, only the highest bidders get access to a specific commodity. This process is called “demand destruction” and can produce parabolic price movements.

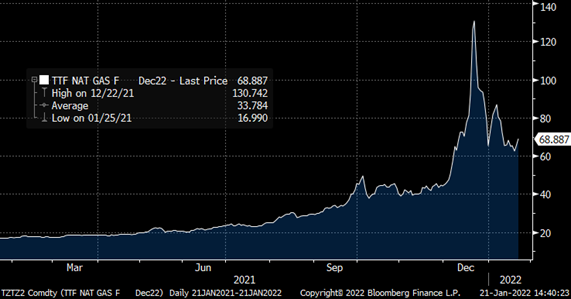

This past year, we saw an example of “demand destruction” price action in European natural gas (TTF). Weather seasonality impacted a very inelastic demand while shifting energy priorities related to net-zero goals, and regional geopolitics caused a shift on the supply side.

We expect to see more demand destruction across the commodities complex in 2022.