This past Friday, September 9th, Bill Dudley was on air early morning making the case that the Fed wants a strong dollar. We know very well why the Fed needs a strong dollar. We wrote on July 25th about the relationship between inflation expectations and the currency’s strength:

“The DXY Dollar index is more than 17 percent up YoY, while the US CPI is 9.1 percent. Being conservative, we can assume a short-run currency passthrough in the US at about 25 percent. This means that if the US Dollar was flat year-over-year, inflation should be a whopping +13%! This blind faith in central banks is what is keeping everything together.” – Macro Minute: We Learn From History That We Do Not Learn From History. July 25th, 2022.

However, how long the Fed can enjoy this position is less clear. Free-floating exchange rates, as opposed to the traditional view that expects a move to equilibrium at fair value, are inherently unstable. The reason for that is the reflexive nature of exchange rates. A change in exchange rates affects inflation, interest rates, economic activity, and other fundamental factors that then have an impact on exchange rates. This effect creates self-reinforcing and self-defeating processes that are very pronounced in currency markets.

In the case of the US dollar today, the fundamentals and nonspeculative transactions point in the direction of depreciation. It is only when looking at speculative transactions that we can find an explanation for the strength of the dollar in the past 12 months. In reality, the classification of speculative and nonspeculative is much more subtle, but for the purposes of this analysis, a simplified version of the model should suffice.

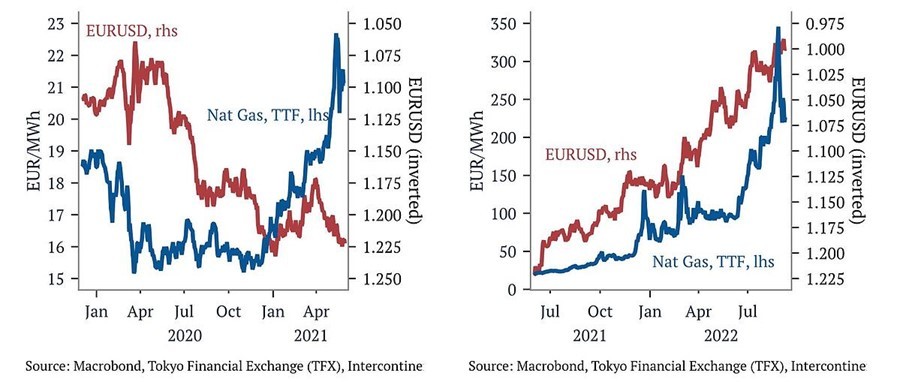

Non-speculative capital flows arise from the need (not the choice) to buy or sell dollars. On this account, all the fundamentals point towards the depreciation of the US dollar. The need to finance the US twin deficits is not new, but it has increased meaningfully recently. But one component in particular is seeing the largest changes- the need for USD in commercial transactions. Charles Gave, co-founder of Gavekal, wrote an excellent piece on “Network Effects and De-globalization.” In it, he proposes that reserve currencies benefit from the network effect, and that the turning point for the demand for US dollar transactions happened when the US insisted upon oversight of all US dollar transactions anywhere in the world. He argues that the catalyst for accelerating the contraction of this network was the US sanctioning Russian assets earlier this year. This decline has so far been masked by an increase in demand for USD coming from the energy crisis in Europe. We agree with that analysis and we can see the relationship between natural gas prices in Europe and the EURUSD (inverted axis) pre and post-mid-2021 below.

Speculative capital, on the other hand, is attracted by rising exchange rates and rising interest rates. Of the two, exchange rates are by far the most important. It does not take very large movements in exchange rates to render the total return negative. In other words, speculative capital is motivated by expectations of the exchange rate, a reflexive process. And when markets are dominated by speculative flows, they are purely reflexive. This is a very unstable situation. The self-reinforcing process tends to become vulnerable the longer it lasts, and it is bound to reverse itself, setting in motion a process in the opposite direction.

This is an obviously oversimplified model, but it brings useful conclusions. When the inflow of speculative positions cannot keep pace with the trade deficit, rising interest obligations, and lower demand for trade in US dollars, the trend will reverse. When that happens, the reversal may accelerate into freefall, as the volume of speculative positions is poised to move against the dollar not only on the current flow, but also on the accumulated stock of speculative capital. Lastly, when that happens, the exchange rate will have an impact on fundamentals (inflation and inflation expectations) which in turn will have an impact on exchange rate expectations in a self-reinforcing process. All of this will make the Fed’s job that much harder.

Given the unpredictable nature of speculative flows and self-reinforcing trends, we can’t say for certain when this will happen, but if pressed for an answer, I would say in the next 9 months. If the US dollar maintains or accelerates its trend during this period, the EUR would have to be trading below 0.86, the JPY above 170, and GBP below parity. And if it doesn’t, the reversal would be dramatic, if not catastrophic.