China Reopens

Over the course of November, rumors gave way to real policy and rhetoric changes from the Chinese government pointing to a gradual reopening of China’s economy and the backing off of Zero-Covid policies. We saw a modest rally in commodities and beat-down Chinese tech names moved higher in the equity market, but an examination of asset class performance as lockdowns reversed in the West can give us some clues to the performance of asset classes over the next several months.

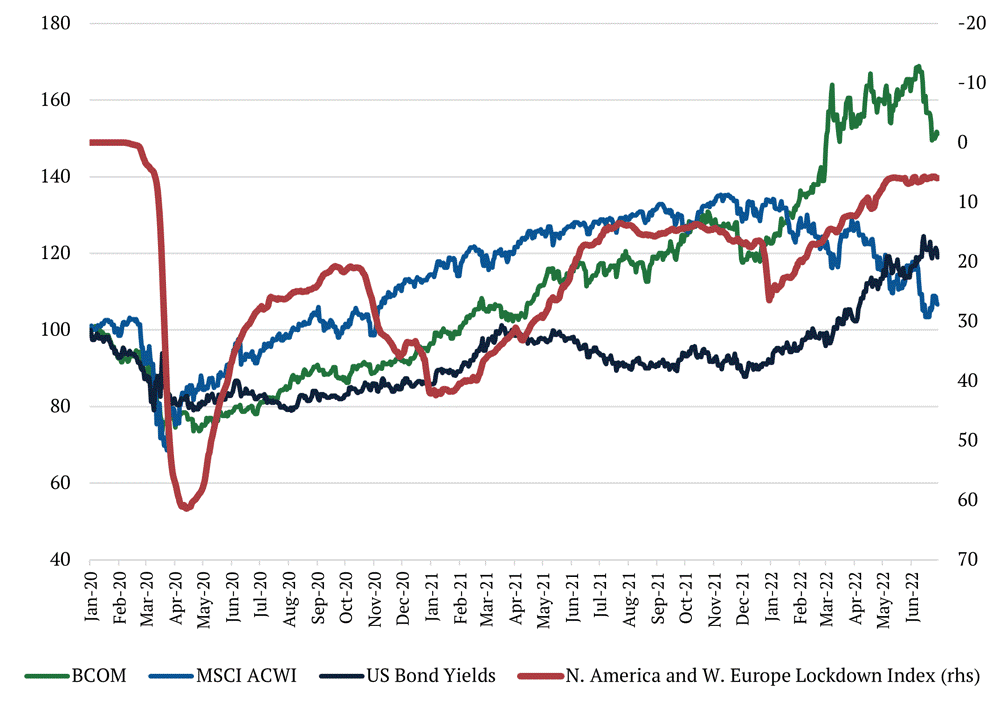

At the onset of Covid, swift and extreme lockdowns drove commodity and equity prices lower, as well as the yields on long-dated US Treasury bonds (using TLT as a proxy). As the first wave of lockdowns eased, we can see that the first asset class to move back towards pre-covid levels was equities (using MSCI ACWI as a proxy), where the rally didn’t cool off until central banks began hiking rates and yields on US long bonds began to recover in 2022. Commodity markets moved next, with increasing economic activity from less severe lockdowns leading to increased consumption of commodities, be it agricultural or energy. The correlation between commodity prices and Western lockdowns is fairly strong; commodity prices (using Bloomberg Commodity Index as a proxy) traded range-bound when the lockdown index flat-lined in 2021, and then began to rally again as lockdowns effectively reversed as we entered 2022 before trading effectively range-bound again.

With the reopening of China, we’d expect a similar phenomenon. Equities price expectations of future cash flows and are likely to be the fastest asset class to recover with new policies as investors discount greater cash flow in the coming years from an open China. Commodities are a real asset, and while speculative capital is active in the space, demand will have to pick up with increased economic activity for fundamentals to move prices higher. Using the same Lockdown Index methodology used above for North America and Western Europe, even with recent relief, China is somewhere between 35 and 50, equal to that of Western economies in the summer of 2020 or early-2021.

China is one of the largest consumers of commodities in the world. Looking through the weakness in backward-looking Chinese data will be important when determining where commodities prices may be heading.

FOMC December 13-14th, 2022

At the same time, we’re looking ahead to next week’s FOMC meeting. In June, after the Fed introduced jumbo-sized 75 basis point hikes, commodity prices and inflation breakevens fell, bonds rallied, and the market began to price a Fed pivot resulting in a bout of easing financial conditions ahead of the July meeting. The Fed considers tighter financial conditions essential to achieving goals around price stability, and after the market perceived the July press conference as dovish, Chair Powell used his speech at Jackson Hole to drive home the Fed’s goals for tighter financial conditions.

Since the November meeting when the Fed alluded to slowing the pace of rate hikes, financial conditions (as measured by the GS US Financial Conditions Index) have once again loosened to where they were at the June FOMC meeting and 10-year bonds have also aggressively rallied, with yields similarly around where they were at the June meeting. Given the Fed’s focus on tighter financial conditions, and its response the last time conditions loosened so quickly, we expect a combination of more hawkish rhetoric and/or a more aggressive dot plot to drive financial conditions tighter and yields higher coming out of next week’s meeting.