Since the Great Financial Crisis, monetary policy has emerged as a critical factor for investors. Gaining insight into central banks’ perspectives on the natural level of interest rates and their limitations crucial for achieving significant investment returns.

Why it matters: The Federal Reserve faces a challenge in balancing the long-term monetary policy rate needed to meet inflation targets (r*) with the level of the real interest rate that can potentially lead to financial instability (r**). Past experiences have demonstrated that, when confronted with this decision, the Federal Reserve has typically prioritized financial stability.

Financial Stability Real Interest Rate

The concept of the natural real interest rate, r*, has long been associated with macroeconomic stability. However, recent research[1] introduces a complementary notion called the “financial stability real interest rate,” r**. By examining the relationship between interest rates, financial vulnerability, and the real economy, we can uncover valuable insights into the dynamics of the financial system.

Defining the Financial Stability Real Interest Rate

The financial stability real interest rate, r**, is the level of the real interest rate that generates financial instability. It is quantified based on an environment where financial intermediaries face occasional binding credit constraints, leading to asset fire-sale dynamics. This two-state framework differentiates between financially tranquil periods and financial crises. r** serves as a quantitative summary statistic for financial stability, akin to r*’s role in measuring macroeconomic stability.

Implications of Interest Rate Movements

Consider a scenario with prolonged lower real rates. Initially, financial intermediaries benefit as their asset portfolios appreciate, boosting net worth and reducing leverage. Consequently, they are more willing to lend. However, the pursuit of higher yields leads to increased exposure to risky assets over time. This growing vulnerability makes intermediaries susceptible to the risk of insolvency in the face of future adverse economic shocks.

Interest rate changes have distinct impacts on financial stability in the short and medium run. In the short run, valuation effects similar to those observed during the 2023 banking turmoil dominate. r** measures the extent to which a surprise increase in rates can push the economy towards a crisis during tranquil periods. Conversely, during financial crises, r** indicates the necessary rate cut to alleviate the balance sheet constraints on financial intermediaries.

Interpreting Banking Turmoil

The collapse of Silicon Valley Bank provides a narrative to interpret financial vulnerabilities within the proposed framework. Two key elements, leverage ratio and the ratio of safe assets to total assets, play a crucial role in determining the banking sector’s vulnerability. The combination of a rapid increase in the Fed funds rate and quantitative tightening resulted in reduced reserves (considered safe assets) and potential unrealized losses in long-term Treasuries. These factors heightened effective leverage and raised financial vulnerabilities. Sales of such securities to meet deposit withdrawals exacerbated these vulnerabilities.

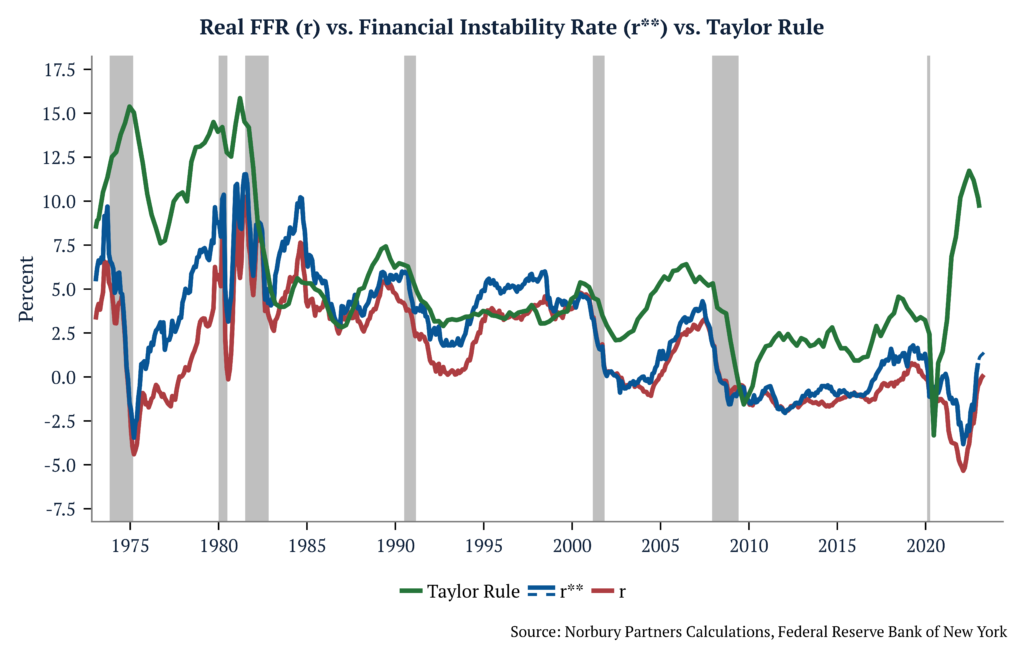

Evolution of the Financial Stability Real Interest Rate (r**)

Tracking the evolution of r** from the 1970s to 2022, notable patterns emerge. During the first part of the Great Moderation period, r** was consistently higher than r, with only short-lived stress episodes causing deviations. In the 2000s and after the Great Recession, the gap between r** and r narrowed. However, in the mid to late 2010s, r** once again surpassed r, except during brief periods of stress. The COVID-19 pandemic brought about significant financial stress in March 2020.

The concept of the financial stability real interest rate, r**, offers insights into the relationship between interest rates and financial stability. By considering the dynamics of the financial system, the effects of interest rate changes on vulnerability, and the implications for the real economy, policymakers gain valuable tools for decision-making.

The authors, affiliated with the Federal Reserve Bank of New York’s Research and Statistics Group, caution that r** should be viewed as a current indicator of financial stress rather than a predictor of future vulnerabilities. However, upon closer examination, we find that this model presents an inherent dilemma between the long-term monetary policy rate required to achieve inflation targets (r*) and the level of the real interest rate that gives rise to financial instability (r**). History has shown that, when faced with this choice, the Federal Reserve tends to prioritize financial stability.

[1] Measuring the Financial Stability Real Interest Rate, r** – Liberty Street Economics (newyorkfed.org)