We believe that 2021 marked the beginning of a secular bull market in commodities and commodity-related equities, with the usual peaks and troughs along the way. A decade of underinvestment by producers and refiners of natural resources coupled with burgeoning excess demand for those resources driven by a myriad of global initiatives including electrification, food security, and energy independence has shifted the long-term supply-demand outlook into deficit for many commodities.

Going back to the 1970s, a period where many investors are looking for clues given the recent run-up in inflation globally, commodity prices and related equities enjoyed a bull market that only ended in 1980 with the collapse of a commodity bubble. In the early 1980s, oil prices began to drop, and at the same time the Federal Reserve was credibly moving to “break the back of inflation”. Since then, we lived through a constant cycle of disinflationary forces that ended in the mid-2010s.

Almost all crises since the 1980s were balance sheet crises, and therefore deflationary. The Japan bust, the Asian crisis, the sub-prime crash, and the Euro crisis were all balance sheet and banking crises. Those crises were deeply deflationary in an already deflationary environment. As balance sheets were negatively impacted, borrowers constrained consumption and investment to pay down debt, while at the same time banks constrained lending, which in turn negatively impacted the price of assets used to collateralize said debt, restricting banks’ ability to lend in a never-ending vicious cycle… until governments stepped in.

Global demographics served as a tailwind for labor and led to an increase in savings that got recycled into US Treasuries – colloquially known as the global savings glut. With the fall of the Berlin Wall in 1990 and China being admitted to the WTO in 2001, globalization went into overdrive as companies could tap into a global labor force, resulting in even more disinflation.

Equities and commodities have swapped market leadership in cycles averaging 18 years in length for over a century. Over time these cycles have become shorter with technological advancements, but they are still fairly consistent, predictable, and long. Commodity price bubbles tend to bust after military or economic conflicts due to the well-known “peace dividend” which drives lower commodity and input costs, better profit margins, higher equity multiples, and more leverage brought on by lower rates and a low-inflation environment. Conversely, when equity bubbles deflate, inflation resurges. Large amounts of debt that were accumulated during the expansionary phase must be reduced using a combination of inflation and defaults. When that happens, easy monetary policy follows, and military or economic conflict once again occurs, perpetuating the long-term cycle.

In the subsequent sections of this report, we examine in detail three probabilistic scenarios for what the medium- to long-term outlook in markets may be, but a summary of the analysis is as follows.

(1) Sustained growth and higher prices via re-leveraging of consumers, a renewed corporate investment cycle, and the build-up of inventories in a more inelastic supply environment. This view is anchored in the belief that the world is transitioning from slack to generally tight commodities supply. (P = 55%)

(2) Rising conflict, disruptions, and nonlinear upside price movements leading to a prolonged period of stagflation. Major wars (or other exogenous shocks like pandemics) produce high inflation, and even minor wars can interrupt trade. Conflict and inflation are intrinsically linked, especially coming out of a period of extreme money supply growth. (P = 35%)

(3) Continued price disinflation or deflation, western-dominated status quo, resumption of the technology capital expenditure boom, and prolonged strength for US equity index returns. In this scenario, the belief is that the Fed will not be as aggressive in hiking rates this cycle given the unsustainable divergence between rising debt as a percentage of US GDP and the falling nominal GDP growth derived from that debt. (P = 10%)

The above scenario analysis and applied probabilities shape our forward-looking market views and positioning. Throughout this report, we provide the economic data and analysis in support of these ideas, and a summation of the key points can be found below:

- We believe that for at least the next few years, we are entering a new environment for inflation with consistently higher price levels. Some indicators to watch for are surging real estate prices, high money supply growth, large fiscal deficits, strong commodity prices, increasing geopolitical instability, and stretched valuations for the US dollar.

- In that period, we also expect strong nominal GDP growth, while the outlook for real GDP growth is more uncertain given the rising risk of conflict or a central bank miscalculation.

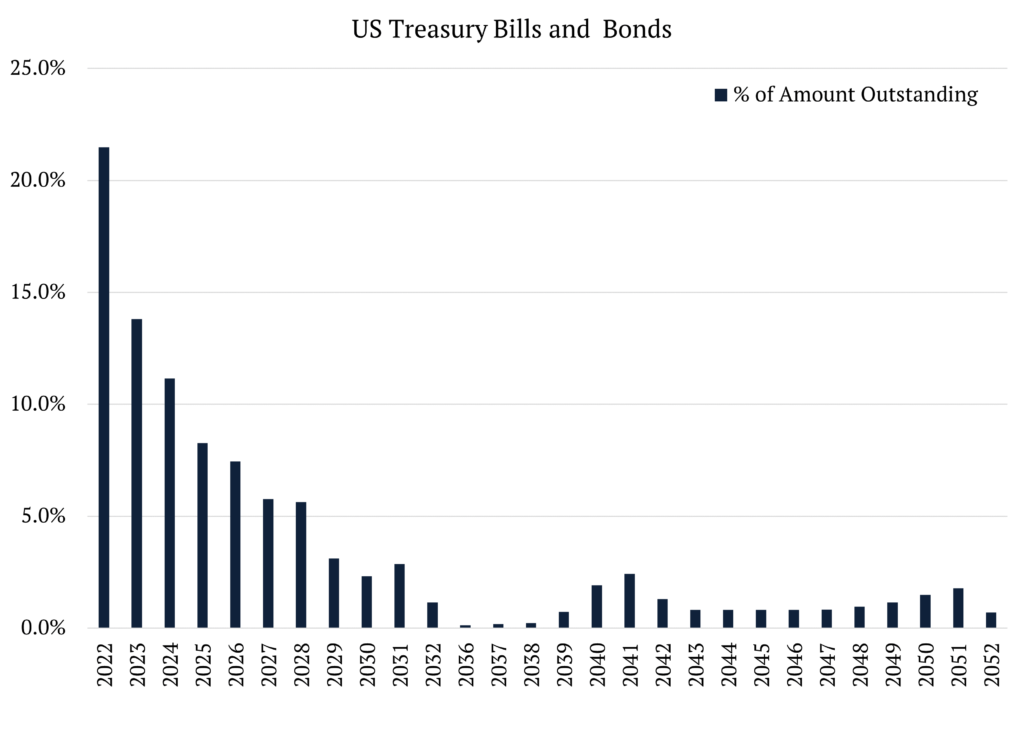

- Rising inflation will lead to Fed rate hikes, but the governors may have little choice but to return to an accommodative stance due to the “hangover” of past financial excesses and, potentially, war. Government roll-over rate risk is very large, with approximately two-thirds of United States federal debt maturing in the next four years.

- We expect strong global commodity demand and commodity prices to be a central theme as well. Poor profits have discouraged investment by commodity producers since the mid-2000s, and the growth of sustainability concerns has exasperated the underinvestment.

- With supply already in short store, producers have moved from the last decade of short duration investment – restock, destock, capex binge, balance sheet distress, capital raise, boom, and bust – to longer duration, disciplined capex cycles.

- As a result of these dynamics, we expect commodities to outpace the S&P 500 over the next few years. Commodities become a defensive asset in commodity-driven recessions.

- We see single-digit compound returns for the S&P over the period. The first part of the period will see negative returns and the later part low positive returns, as the focus shifts from multiple compression and falling earnings to cheaper valuations. Free cash flow generation will be key in both phases.

- Inflation could be made significantly worse if increasing geopolitical instability leads to wars.

Given this outlook, we have built positions across the commodity complex, the core ones being in industrial metals – namely copper, aluminium, and cobalt – emission allowances, and grains. Alongside those positions, we have further built upon the theme through equity allocations to global energy refiners investing in renewable fuels (e.g., sustainable aviation fuel, renewable diesel), miners and refiners of industrial metals who lead in low carbon intensity production, and industrial companies exposed to the renewable revolution with large market share and pricing power. We expect the supply-demand fundamentals facing commodity markets to persist for many years, pressuring prices and having a negative impact on prevailing market sentiment, with a particular emphasis on long-duration assets. We will be hedging a portion of our equities exposure by betting against indices we find to be richly valued given our probability-weighted scenarios. We expect interest rates, especially in the developed world, to make higher highs and higher lows over the next few years, a quasi-mirror image of the lower highs and lower lows of the deflationary past few decades. Lastly, we believe that the currencies of commodity-exporting nations will benefit greatly from this scenario.

To arrive at these views, we have done extensive research that involves proprietary information and third-party data. If you are interested in a full copy of the report, please contact [email protected].