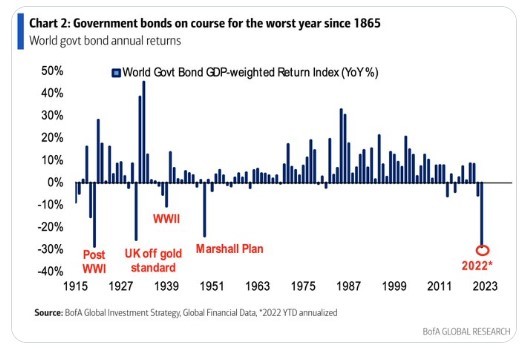

When looking at the return of assets for the first half of the year, we find that US bonds posted their worst first half-year performance for over 100 years, while the S&P 500 declined 20.6% year-to-date, recording the worst first half of the year since 1970 and its 4th worst start on record. More broadly, the MSCI All Country World was down 20.9% for the period. Institutional investors are having one of their worst performance periods on record with the trusted 60/40 portfolio declining by 17% YTD, making it the second-worst start since the 1900s.

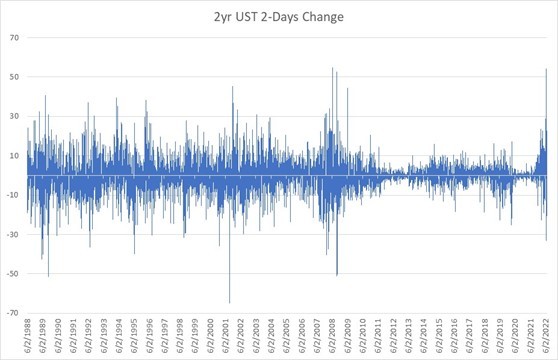

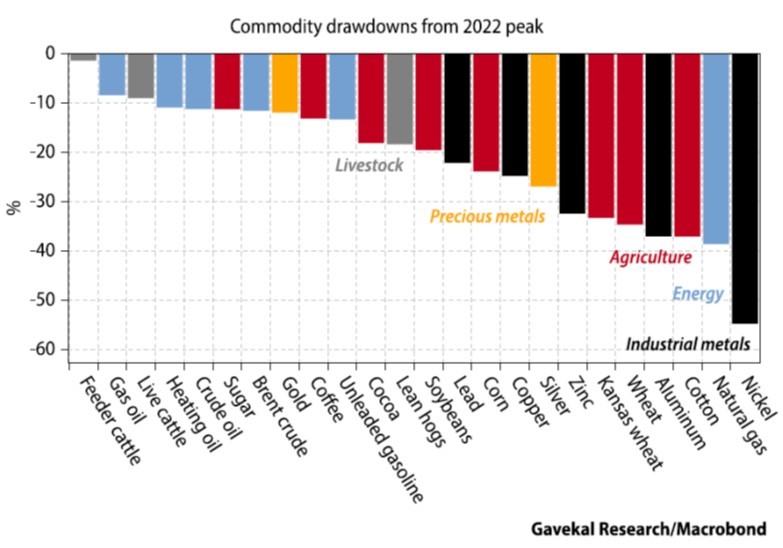

The month of June was marked by a sharp repricing of recession fears along with a VaR shock that led to risk reduction and high correlation across markets, providing very few opportunities for hedges and diversification. During the month, 10-year treasuries increased +16bps, with the difference between the 10 and 30-year bonds flattening by 3bps. The 2-year bond yield increased by almost +40bps for the month and jumped +54bps in two trading sessions, the largest move since 2008 when it moved +55bps. The S&P and Nasdaq were down -8.4% and -8.7%, while Energy and Materials sold off -18% and -15%, respectively. Commodities were down across the board, ranging from -10% to -40% in agriculture commodities, and -22% to -57% in industrial metals. In other words, you could not make money in June by being long.

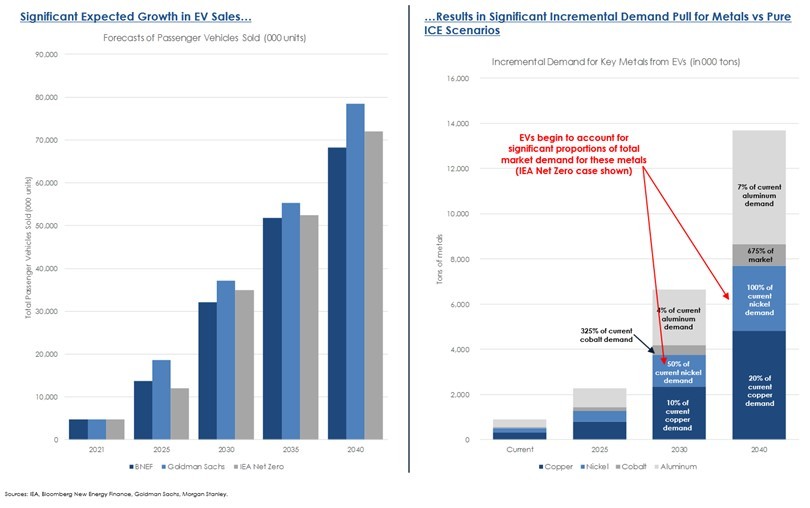

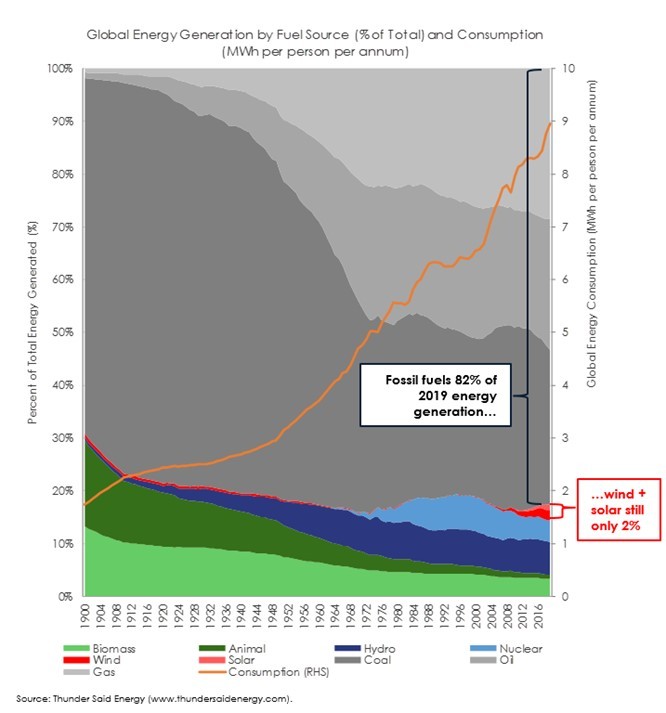

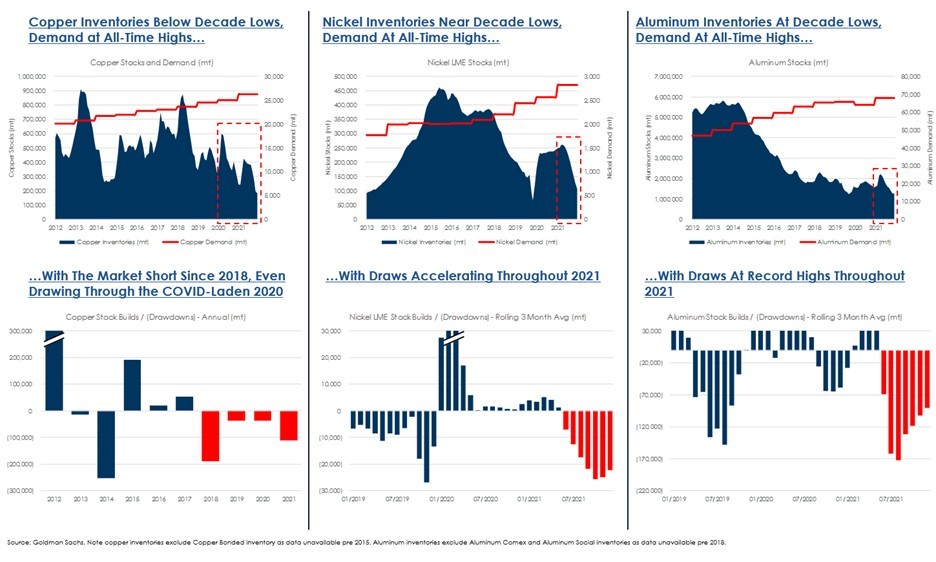

Looking at the long-term we believe that commodity and commodity-related equities exposed to the green energy transition have an exceptional demand backdrop that arises from decarbonization initiatives that will only increase going forward while also possessing major supply challenges. As an example, the average EV consumes five to six times more copper than a combustion engine vehicle. Conservative estimates of EV production put copper demand, just from this source, increasing 20-25% over the next two decades. This does not even account for the increasing demand for copper arising from other electrification needs like batteries and cables.

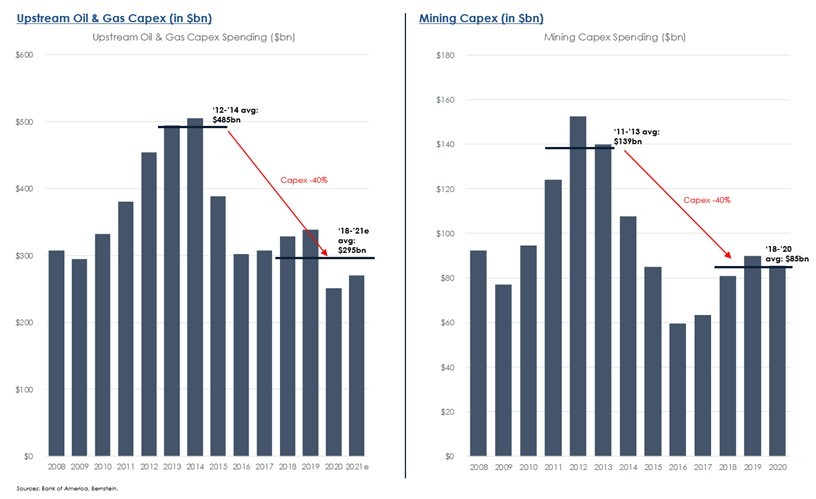

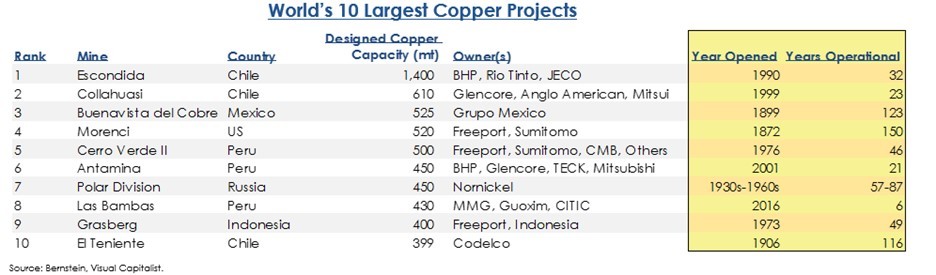

This is happening against the backdrop of virtually no production increases and very low inventory levels. Mining companies learned from their mistakes in the previous CAPEX cycle of the early 2000s, and along with the more recent price declines and volatility, board members will not be in a rush to invest in capacity. Rather, they will prefer dividends and share buybacks.

On a March 1st podcast interview with Eric Mandelblatt, he says “(…) three of the largest copper mines in the world were developed over 100 years ago. There’s been only one of the 10 largest copper mines in the world that’s been developed this century since (2001). So, you have this situation where supply in the near term is highly inelastic.”

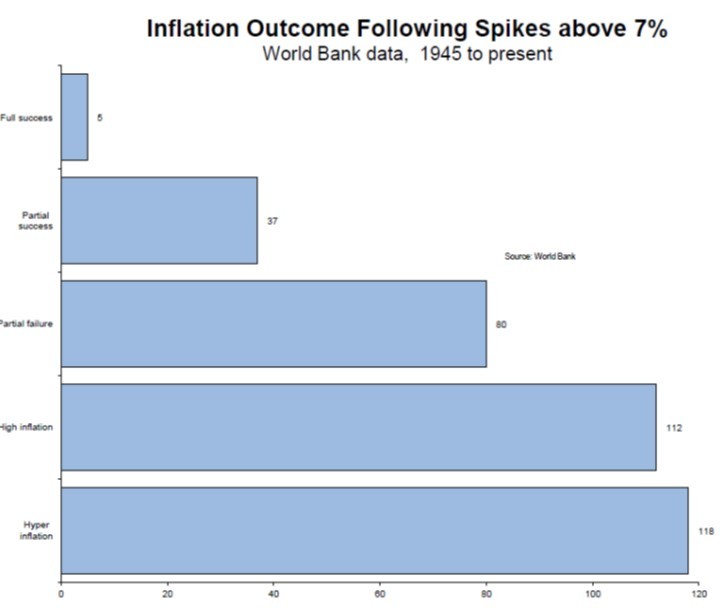

Reflecting on the recent commodities drawdown, we put too much weight on the probability that markets would realize early that the Fed won’t be able to run the level of positive real yields required to bring down inflation to its target. Rather, when looking at prices, it appears markets are pricing the Fed outlook to perfection. We are now accounting for that and expecting that the crucible moment will occur after the Fed reaches their expectation of terminal rate, or just above, and inflation is still above target. At that moment, the Fed will either have to prove credible, or the market should then realize that the Fed will let inflation run above target for longer. It is worth pointing out that history is not on the Fed’s side. Vicent Deluard from StoneX shows that, historically, central banks only manage to bring inflation down to 3% in each of the next 5 years, following a spike above 7%, in less than 1.4% of the time. What we see today is a market that blindly believes in the Fed and prices that 1.4% probability scenario with full certainty, while completely dismissing the other scenarios.

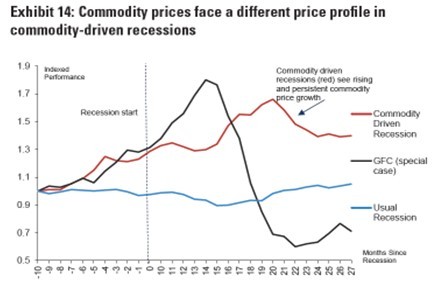

Also, we did not expect the market to aggressively price in a deflationary bust scenario so rapidly after a higher-than-expected inflation print and still extremely negative real rates. We expected that during this secular bull market in commodities, we would see some ups and downs in prices, but the speed and magnitude of these moves only compare to 2008, which was a massively deflationary bust period. We assign a very small probability of that scenario (for a detailed analysis on this, please see our recently published annual report), and we believe that if a recession is around the corner, it would be an inflationary bust instead.

With the supply of commodities constrained, even a short-term decrease in demand would not fix the problem of inflation, it would only postpone it to the following part of the cycle when policies revert to accommodative to shore up demand. We know from history that during inflationary busts, commodities have two-thirds of their upward move after a recession begins.